Life Insurance Online for Beginners

Whole Life Insurance Louisville - An Overview

Table of Contents4 Easy Facts About Life Insurance Companies Near Me ShownThe Of Life Insurance CompanyThe Buzz on Cancer Life InsuranceThe Basic Principles Of Whole Life Insurance Louisville Not known Factual Statements About Life Insurance Company How Cancer Life Insurance can Save You Time, Stress, and Money.Some Ideas on Life Insurance Company You Need To Know

Pick a Strategy and also Sign up Various kinds of strategies aid you obtain as well as spend for treatment in a different way - Life insurance. Fee-For-Service (FFS) strategies normally make use of 2 methods. Fee-for-Service (FFS) Plans (non-PPO) A conventional sort of insurance policy in which the health insurance will either pay the medical service provider directly or compensate you after you have submitted an insurance coverage claim for each covered clinical expenditure.This technique may be much more pricey for you and also need extra documents. Fee-for-Service (FFS) Strategies with a Preferred Carrier Organization (PPO) An FFS option that permits you to see medical providers that decrease their costs to the strategy; you pay less cash out-of-pocket when you use a PPO provider. When you go to a PPO you usually won't need to file cases or paperwork.

The 6-Minute Rule for Senior Whole Life Insurance

In "PPO-only" alternatives, you should use PPO service providers to obtain benefits. Health Care Organization (HMO) A health insurance that supplies care with a network of doctors and also healthcare facilities in particular geographical or service areas. HMOs work with the healthcare service you get as well as free you from completing documentation or being billed for covered services.

Some HMOs are associated with or have setups with HMOs in various other solution areas for non-emergency care if you travel or are far from residence for extended periods. Plans that use reciprocity review it in their brochure. HMOs limit your out-of-pocket expenses to the fairly reduced quantities displayed in the benefit brochures.

The recommendation ensures that you see the best provider for the care most proper to your problem. Treatment obtained from a supplier not in the strategy's network is not covered unless it's emergency situation treatment or the strategy has a reciprocity setup. HMO Plans Offering a Factor of Solution (POS) Item In an HMO, the POS item allows you use companies that are not component of the HMO network.

What Does Whole Life Insurance Louisville Do?

You generally pay higher deductibles and coinsurances than you pay with a strategy carrier. You will certainly also require to file a claim for repayment, like in a FFS strategy. The HMO strategy wants you to utilize its network of suppliers, but identifies that often enrollees intend to pick their own supplier.

Consumer-Driven Health Insurance (CDHP) Describes a vast array of approaches to provide you extra incentive to regulate the cost of either your wellness advantages or wellness care - Senior whole life insurance. You have greater freedom in investing healthcare dollars approximately an assigned amount, and also you get full insurance coverage for in-network precautionary treatment.

The tragic limitation is typically more than those common in various other strategies (Senior whole life insurance). High Deductible Health Insurance (HDHP) A High Deductible Health Insurance is a medical insurance plan in which the enrollee pays an insurance deductible of a minimum of $1,250 (Self Only insurance coverage) or $2,500 (family members insurance coverage). The yearly out-of-pocket quantity (including deductibles and copayments) the enrollee pays can not go beyond $6,350 (Self Just coverage) or $12,700 (family insurance coverage).

The Of Cancer Life Insurance

HDHPs can have very first dollar coverage (no insurance deductible) for preventive treatment and greater out-of-pocket copayments and also coinsurance for services obtained from non-network providers. HDHPs used by the FEHB Program develop as well as partly fund HSAs for all eligible enrollees and also provide a similar HRA for enrollees that are ineligible for an HSA.

For more information please evaluation our HDHP Rapid, Truths. Health And Wellness Repayment Arrangement (HRA) Health Reimbursement Setups are a common function of Consumer-Driven Health Plans - Life insurance. They may be described by the health insurance under a various name, such as Personal Treatment Account. They are also offered to enrollees in High Deductible Health And Wellness Strategies who are disqualified for an HSA.

Health And Wellness Interest-bearing Accounts (HSA) A Health and wellness Savings Account enables individuals to pay for current health and wellness costs as well as conserve for future qualified medical expenses on a pretax basis. Funds deposited into an HSA are not exhausted, the balance in the HSA expands tax-free, and also that quantity is readily available on a tax-free basis to pay clinical prices.

Getting My Senior Whole Life Insurance To Work

HSAs undergo a number of guidelines and also constraints established by the Department of Treasury. Go to Division of Treasury Resource Facility to find out more.

There are several sorts of insurance policy that secure against economic loss. Typical insurance kinds include residential property, auto, wellness, and life insurance policy. Each of the usual insurance coverage kinds have a variety of sub-types bring about a vast array of selections even for simply the typical insurances. Past the common insurance policy types there are additionally a number of various other insurances that range from criteria like travel insurance policy and service warranties, to FDIC guarantees and also worker's payment.

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)

Child Whole Life Insurance Fundamentals Explained

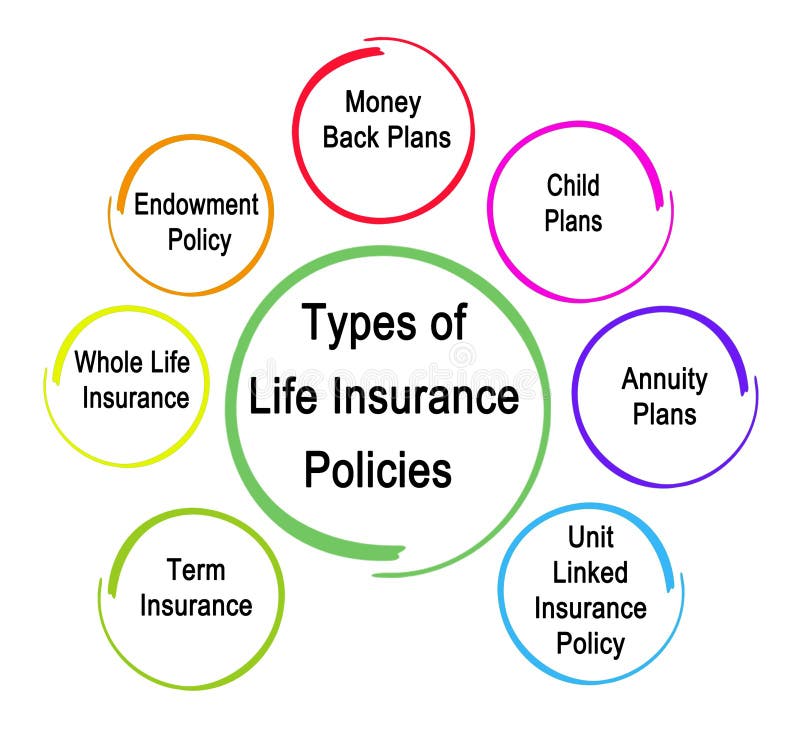

Past what sort of vehicle is insured there a variety of different types of car insurance in relation to what the driver is accountable for in case of a mishap and what lawful, medical, and also automobile associated fees the insurer will certainly be accountable for. Common medical insurance kinds include: Responsibility insurance coverage Collision insurance coverage Comprehensive insurance coverage Injury coverage Without insurance/ Underinsured Motorist Security look at more info There are a variety of various sorts of life insurance, however there are just two primary kinds those are term and entire life.

Common sorts of life insurance policy consist of: Term life Whole life Universal life Variable life Whether it's a commercial or home lots of kinds of property require residential property insurance - American Income Life. Various other big ticket products like watercrafts or even a cars and truck can be considered home, as well as while these are insurable we will cover those under different areas.

Typical building insurance types include: Property owners insurance policy Tenants insurance Flood, earthquake, as well as various other catastrophe insurance policies Home mortgage and also title insurance Business Insurance and Commercial Residential Property Insurance policy Much like house business homeowner and also organization proprietors require their own kinds of insurance policy. Considering that "service" is an overarching subject some company insurance coverage's consist of other insurance types.

The smart Trick of Life Insurance Louisville Ky That Nobody is Talking About

Important insurance policy types for company owner include: Entrepreneur's insurance policy Professional responsibility insurance Business property insurance coverage Also included are points like aviation, computer, marine, and also much more. When organizations use costly tools or run lorries they commonly have insurance coverage alternatives for these things and their responsibility. Travel Insurance policy Because taking a trip is a typical point giving travel insurance policy it's own insurance type makes feeling.